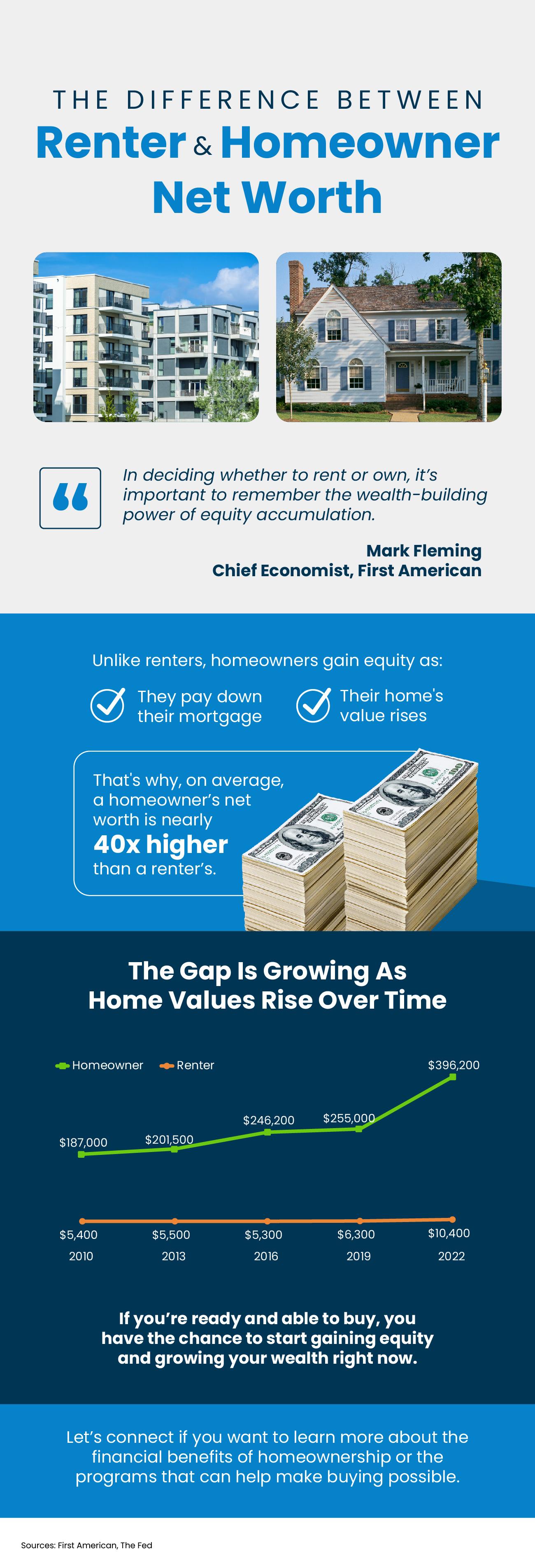

The Big Difference Between Renter and Homeowner Net Worth

Some Highlights

- If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of homeownership.

- Unlike renters, homeowners gain equity as they pay their mortgage and as home values rise. That’s why, on average, a homeowner’s net worth is nearly 40x higher than a renter’s.

- Connect with an agent if you want to learn more about the financial benefits of homeownership or the programs that can help make buying possible.

Recent Posts

Is Wall Street Really Buying All the Homes?

Don’t Let These Two Concerns Hold You Back from Selling Your House

The Big Difference Between Renter and Homeowner Net Worth

Should You Sell Your House or Rent It Out?

More Homes, Slower Price Growth – What It Means for You as a Buyer

What’s Motivating Homeowners To Move Right Now

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

Should You Wait for Spring? The Perks of Buying in the Off-Season

Why You Need an Agent To Set the Right Asking Price

Renting vs. Buying: The Net Worth Gap You Need To See